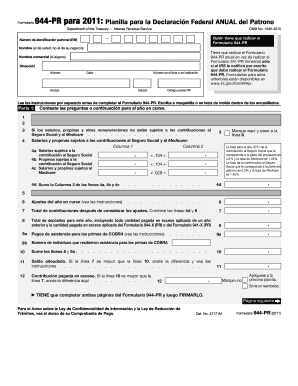

IRS 8546 2024-2026 free printable template

Instructions and Help about IRS 8546

How to edit IRS 8546

How to fill out IRS 8546

Latest updates to IRS 8546

All You Need to Know About IRS 8546

What is IRS 8546?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8546

What should I do if I realize I made an error after submitting IRS 8546?

If you discover a mistake in your IRS 8546 after submission, you can file an amended form to correct any inaccuracies. Ensure that your amendment clearly states the changes made and includes the correct details. Keep copies of any correspondence for your records to avoid complications.

How can I check the status of my IRS 8546 after filing?

To verify the status of your IRS 8546 after submission, you can use the IRS online tools or contact the IRS directly. These tools may provide updates on the processing of your form or alert you to any issues. It's advisable to keep the submission confirmation for future reference.

Are e-signatures acceptable for IRS 8546 submission?

Yes, e-signatures are accepted for IRS 8546 submissions under certain conditions. Ensure your e-filing software complies with IRS requirements for digital signatures. Retain documentation proving consent if filing for another party to ensure proper authorization.

What should I consider if I am filing IRS 8546 for a foreign payee?

When filing IRS 8546 for a foreign payee, it's essential to understand the specific tax obligations and reporting requirements for non-residents. Ensure that you have the necessary identifiers and documentation to accurately represent the foreign payee on the form. Consulting a tax professional may also be beneficial.

What should I do if my IRS 8546 submission is rejected?

If your IRS 8546 submission is rejected, review the rejection notice for specific reasons, as it will guide your next steps. Common issues include missing information or incorrect formatting. Correct the identified problems and resubmit your form as quickly as possible to avoid penalties.